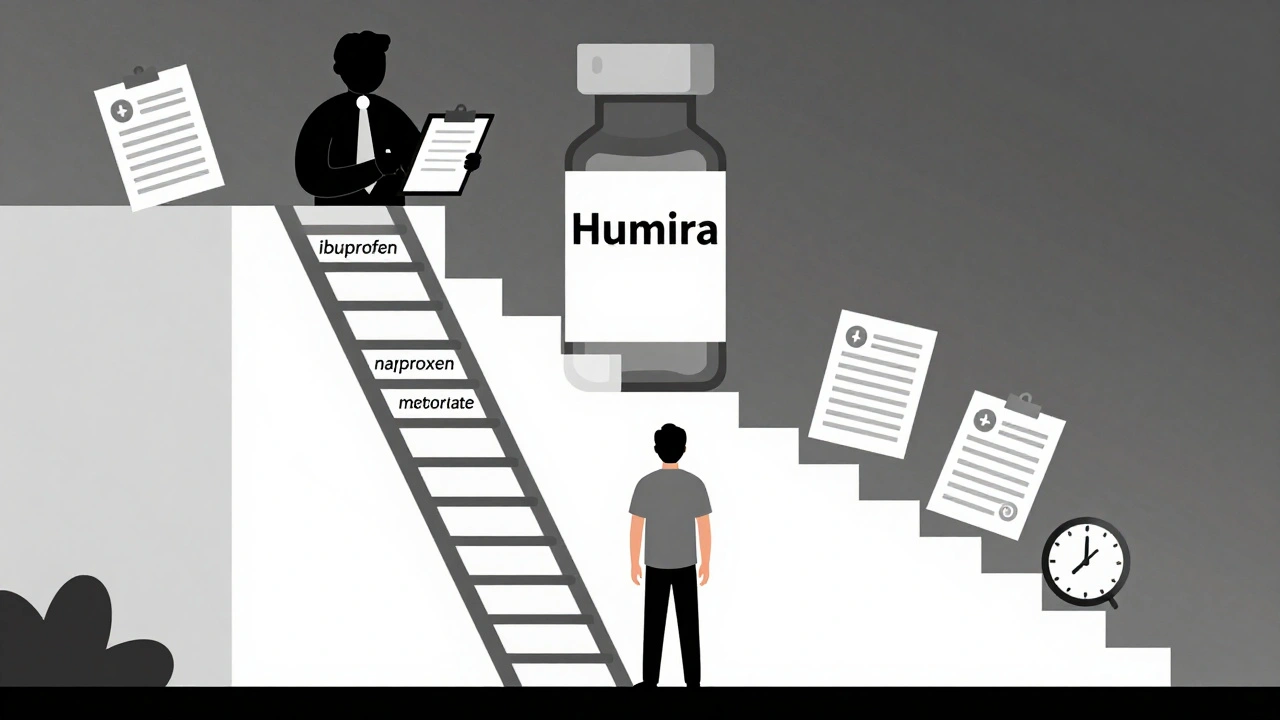

Step therapy forces patients to try cheaper generic drugs before insurers cover more expensive treatments. Learn how it works, when it fails, and what you can do to get exceptions quickly.

Insurance Generics: What You Need to Know About Affordable Medications and Coverage

When you hear insurance generics, brand-name drugs that are legally identical to their branded versions but sold at lower prices, often covered by insurance plans to cut costs. Also known as generic medications, they’re the backbone of affordable healthcare in the U.S. and beyond. Most insurance plans push them first—not because they’re cheaper for the insurer alone, but because they work just as well. The FDA requires them to have the same active ingredients, strength, dosage, and effectiveness as the brand name. That means your blood pressure pill, your antidepressant, your cholesterol med—when it’s generic—does the same job without the premium price tag.

But here’s the catch: not all generic drugs, FDA-approved versions of brand-name medications that are chemically identical and bioequivalent. Also known as generic medications, they are often the default choice for insurers to reduce out-of-pocket spending are treated the same by your plan. Some insurers require prior authorization, limit which manufacturer’s version they cover, or even make you pay more if you refuse a generic. And while most people assume generics are always the cheapest option, that’s not always true—sometimes a brand-name drug with a coupon or patient assistance program costs less than your copay for the generic. It’s not about the pill—it’s about the formulary. Hospitals and pharmacies pick generics based on price, supply reliability, and sometimes hidden rebates from manufacturers, not just clinical data. That’s why switching from one generic to another—even if they’re both labeled the same—can sometimes cause side effects or reduced effectiveness, especially with complex meds like thyroid or seizure drugs.

Then there’s the role of pharmacy benefits, the system insurers use to manage drug coverage, including formularies, tiered copays, and prior authorization rules. Also known as PBMs, they negotiate prices with drugmakers and decide which generics make it onto your plan’s approved list. These middlemen, called PBMs, control which generics you can get, how much you pay, and sometimes even if you can get them at all. A drug might be generic, but if it’s not on your plan’s list, you’re stuck paying full price. And with rising medication costs, the price patients pay for prescriptions, influenced by insurance coverage, manufacturer pricing, and supply chain issues. Also known as drug pricing, it’s a major driver of healthcare stress for millions, understanding your plan’s tiers—Tier 1 for generics, Tier 2 for preferred brands, Tier 3 for non-preferred—is critical. Many people don’t realize they can ask their pharmacist to check if a different generic version is covered under a lower tier. Or that they can appeal a denial. Or that some insurers now offer $0 copays on certain generics as part of wellness programs.

What you’ll find in these articles isn’t theory—it’s real-world insight. From how the FDA ensures generic quality to how hospitals choose which ones to stock, from Australia’s PBS system to why some patients get better results with one generic over another, this collection cuts through the noise. You’ll learn how to read your formulary, when to push back on your insurer, and how to spot when a generic switch might be risky. No fluff. No jargon. Just what works, what doesn’t, and what you need to know to get the most from your coverage.