If you’ve ever been told by your doctor to try a cheaper drug before getting the one they originally prescribed, you’ve run into step therapy. It’s not a glitch in the system-it’s a standard rule built into most health insurance plans. The idea is simple: insurers want you to try the least expensive option first, usually a generic drug, before they’ll pay for something pricier. But what happens when that cheaper drug doesn’t work? Or makes you sicker? And why does it take weeks just to get approval for the medicine your doctor already knows is right?

How Step Therapy Actually Works

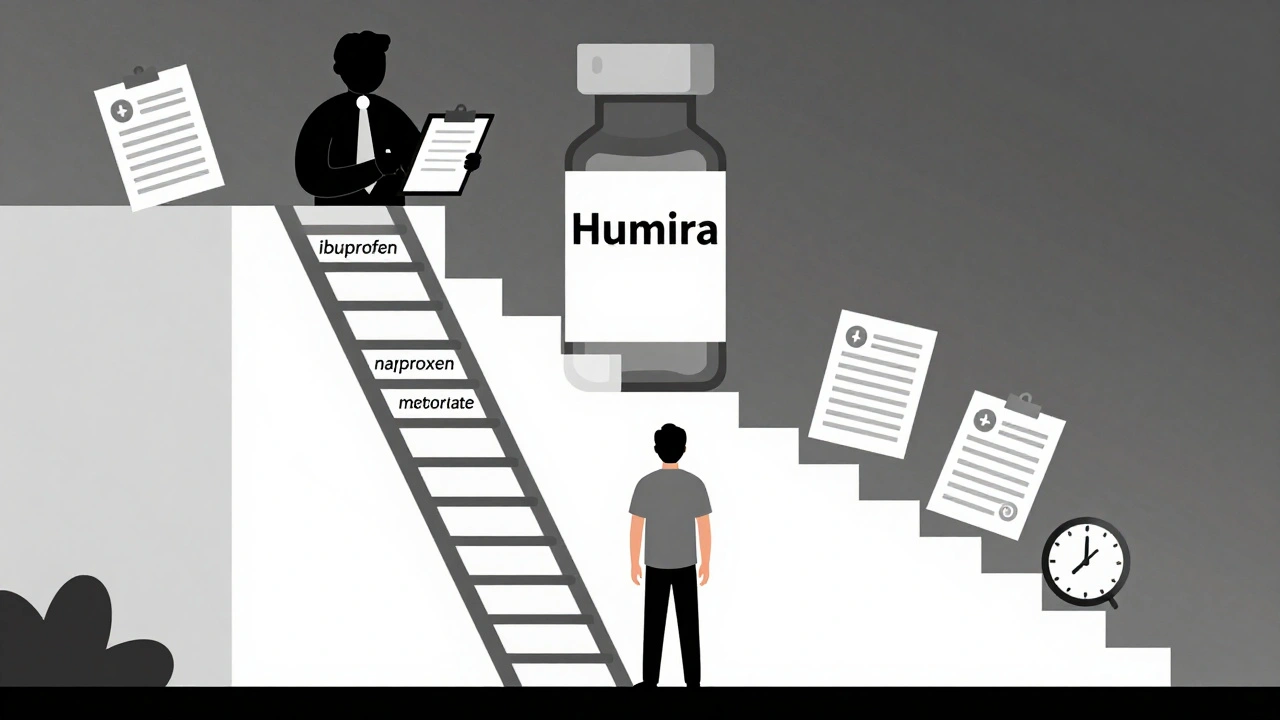

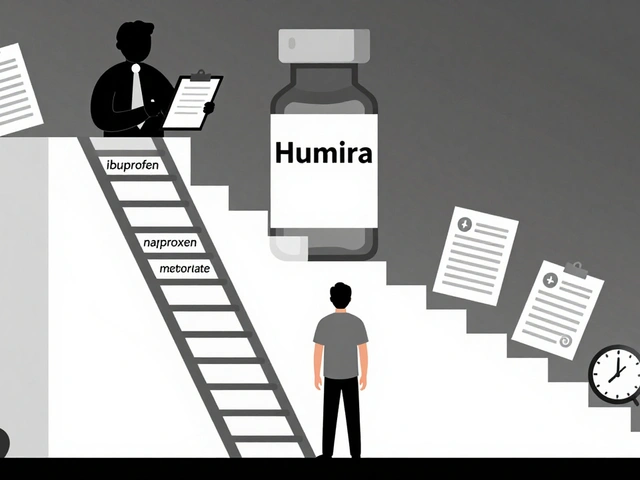

Step therapy, also called a "fail-first" policy, isn’t random. It’s a structured ladder. Your insurance plan lists medications for your condition in order of cost, starting with generics. You have to try and fail at each step before moving up. For example, if you have rheumatoid arthritis and your doctor prescribes a biologic drug like Humira, your insurer might require you to first try two or three generic NSAIDs-like ibuprofen or naproxen-then maybe a traditional DMARD like methotrexate. Only after those fail will they cover the biologic.This isn’t just for arthritis. It applies to asthma inhalers, diabetes meds, antidepressants, even skin conditions like psoriasis. In fact, about 40% of all prescription drug plans in the U.S. use step therapy, according to a 2022 NIH review. That number’s been rising since 2018, and experts predict it’ll hit 55% of specialty drugs by 2025.

Why? Because it saves money. The Congressional Budget Office found step therapy can cut pharmaceutical spending by 5% to 15%, depending on the drug class. For insurers, that’s a big win. For patients? Not always.

Why Doctors Hate It

Your doctor didn’t pick that expensive drug randomly. They looked at your history, your other conditions, your allergies, your lifestyle. But step therapy ignores all that. It treats every patient the same.The American College of Rheumatology says step therapy puts patients at risk. One patient on Reddit shared how she spent six months trying three different NSAIDs before her insurer approved a biologic for her rheumatoid arthritis. By then, her joints were permanently damaged. The Arthritis Foundation found 68% of patients on step therapy suffered negative health effects-42% saw their disease get worse while waiting.

It’s not just about pain. For someone with multiple sclerosis, a delay of four weeks in starting the right medication can mean losing mobility. For someone with depression, waiting weeks for the right antidepressant can mean losing hope. And it’s not just the delay-it’s the paperwork. Doctors spend nearly 18 hours a week just filling out forms to fight insurers over step therapy. That’s time they could be seeing patients.

When Step Therapy Might Actually Help

It’s not all bad. For some people, the first drug on the list works just fine. A 2023 GoodRx survey found 17% of patients ended up doing better on the generic drug their insurer required. They avoided side effects, saved money, and didn’t need to escalate to pricier options.And let’s be real-generics are safe. About 90% of all prescriptions filled in the U.S. are for generics. They’re not "cheap knockoffs." They’re chemically identical to brand-name drugs, just without the marketing cost. If a generic works, it’s a win.

But here’s the catch: step therapy doesn’t ask if a drug will work for you. It asks if it worked for someone else. That’s the problem.

What You Can Do: The Exception Process

You don’t have to accept this. Every plan has to offer a way out-called a step therapy exception. But getting one isn’t easy. You need proof.Here’s what insurers must accept as valid reasons for an exception (based on the Safe Step Act and state laws):

- You’ve already tried the required drug and it didn’t work

- The required drug causes harmful side effects

- The required drug is medically contraindicated for you

- Delaying the right drug could cause permanent damage

- You’re already stable on the drug your doctor prescribed and switching would hurt you

Your doctor has to submit medical records showing this. That means lab results, past prescriptions, notes from previous visits. Some insurers require a letter of medical necessity. Others want a form filled out by your provider. Blue Cross Blue Shield of Michigan says they review standard requests in 72 business hours and urgent ones in 24 hours. But in practice, many patients wait four to eight weeks.

And if your insurance changes? Say you switch jobs and your new plan uses a different formulary? You might have to start the whole process over-even if you’ve been on the same drug for five years. That’s not just frustrating. It’s dangerous.

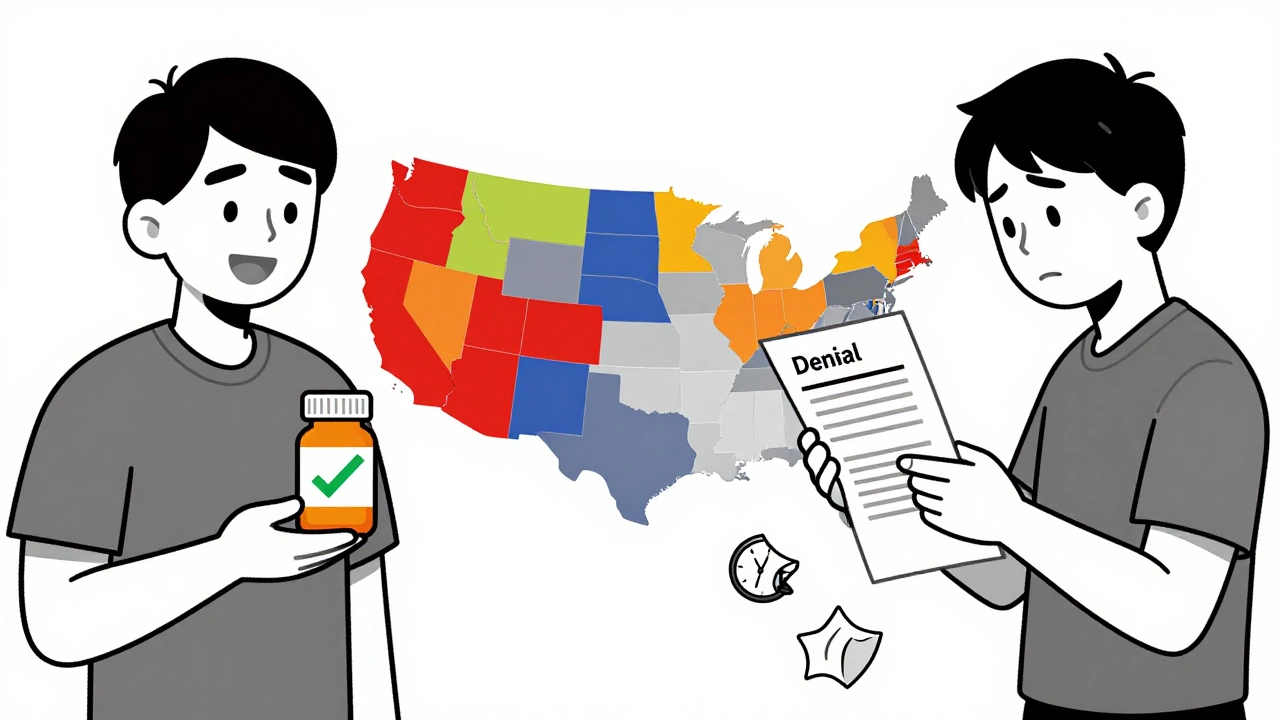

State Laws vs. Federal Gaps

As of 2025, 29 states have passed laws to protect patients from abusive step therapy rules. These laws require insurers to: give clear exception processes, set time limits for responses, and honor doctors’ recommendations in certain cases.But here’s the loophole: if your insurance is through your employer and your employer pays for your coverage directly (called a self-insured plan), state laws don’t apply. About 61% of Americans are covered by these plans, regulated only by federal law. And right now, federal law doesn’t require time limits, clear processes, or even a guarantee that exceptions will be granted.

That’s why the Safe Step Act keeps getting reintroduced in Congress. It would force self-insured plans to follow the same rules as state-regulated ones. But it’s stuck in committee. Until it passes, you’re playing a game with different rules depending on where you live and how you get your insurance.

What to Do Right Now

If you’re stuck in step therapy:- Ask your doctor to file an exception request immediately. Don’t wait. The sooner they submit, the sooner you can move forward.

- Get a copy of your plan’s formulary. Most insurers post it online. Look up your medication and see what steps are required.

- Document everything. Keep copies of prescriptions, doctor’s notes, emails, and denial letters.

- Call your insurer. Ask for a case manager. Ask for the exact reason your request was denied. If they can’t give you a clear answer, escalate.

- If you’re denied, appeal. Most plans have a two-step appeal process. Don’t give up after the first rejection.

- Check if your drug manufacturer offers patient assistance. Many companies provide free or discounted meds if you’re denied coverage. Over 78% of major drugmakers have these programs.

And if you’re paying out of pocket? Talk to your pharmacist. Sometimes the cash price of a brand-name drug is cheaper than your copay after step therapy. It sounds crazy, but it happens.

The Bigger Picture

Step therapy exists because drug prices are out of control. But putting the burden on patients and doctors isn’t the solution. It’s a Band-Aid on a broken system.Insurers say they’re just trying to make care affordable. But when a patient’s condition worsens because they couldn’t get the right drug on time, the cost isn’t just financial. It’s in lost workdays, emergency room visits, and irreversible damage.

There’s a better way: transparent pricing, real competition in drug manufacturing, and policies that put patient outcomes before profit margins. Until then, step therapy will keep being a tool insurers use to save money-and patients will keep fighting to get the care they need.

Helen Maples

December 7, 2025 at 07:15Step therapy isn't just bureaucratic nonsense-it's medical malpractice dressed up as cost-saving. I watched my mother spend nine months trying five different generics for her autoimmune condition. By the time they approved the biologic, her kidneys were failing. The system doesn't care if you live or die-it only cares if the spreadsheet balances. This isn't healthcare. It's insurance roulette.

Ashley Farmer

December 8, 2025 at 10:11I get that insurers are trying to control costs, but there’s a line between frugality and harm. My sister was denied her antidepressant for six weeks because they wanted her to try a generic first. She lost her job. She lost her apartment. She lost herself. Generics aren’t bad-but forcing everyone down the same path ignores the fact that people aren’t data points.

Sadie Nastor

December 8, 2025 at 12:35Honestly? I’m just glad I found a doctor who fights for me 😊 I used to think step therapy was normal until my rheumatoid arthritis flared up because I had to wait for a $0.50 pill to ‘fail.’ Now my doc just submits the exception with my MRI and lab results upfront. Took 3 days. I’m not mad-I’m just glad I didn’t lose my hands. 🙏

Sangram Lavte

December 10, 2025 at 02:24In India, we don’t have this mess. If a doctor prescribes a drug, you get it. Insurance doesn’t interfere. I’ve seen people pay out of pocket for brand-name meds because the generics gave them rashes. The system here feels like punishment for being sick. Why are we letting corporations decide who lives and who suffers?

Stacy here

December 11, 2025 at 06:27They’re not trying to save money-they’re trying to hide how much they’re gouging us. The same drugs that cost $10 as generics cost $800 as brand names because Big Pharma owns the insurers. It’s all one big cartel. The Safe Step Act? It’s dead on arrival because lobbyists write the bills. Your doctor can’t help you. Your state laws don’t matter. Your employer’s plan? A loophole. You’re not a patient-you’re a revenue stream.

Olivia Hand

December 12, 2025 at 14:30I’ve been on step therapy for psoriasis for 14 months. I’ve tried three topicals, two oral meds, and one biologic that made me hallucinate. My dermatologist says I need the drug I’m on now-but the insurer says I need to ‘fail’ on a cream that’s literally for dandruff. I’m not a lab rat. I’m not a cost center. I’m a person with a chronic condition who just wants to live without itching through every meeting.

Desmond Khoo

December 12, 2025 at 17:04My dad’s on step therapy for diabetes. They made him try three generics before letting him have the insulin he’s used for 12 years. He ended up in the ER with ketoacidosis. Now he’s got a case manager who actually answers the phone. Still took 6 weeks. I just wish more people knew they could appeal. Don’t take ‘no’ for an answer. Keep pushing. It’s exhausting but worth it.

Kyle Oksten

December 13, 2025 at 14:00Step therapy is the logical outcome of a healthcare system that treats medicine like a commodity. If you reduce human health to a cost-benefit analysis, you will inevitably sacrifice lives for margins. The real question isn’t whether step therapy works-it’s whether we’re still a society that values human dignity over profit. If the answer is no, then we’ve already lost.

Nicholas Heer

December 14, 2025 at 17:05THIS IS WHY WE NEED TO BAN INSURANCE COMPANIES FROM MEDICAL DECISIONS. THEY’RE NOT DOCTORS. THEY’RE NOT EVEN HUMANS. THEY’RE ALGORITHMS DESIGNED TO MAXIMIZE SHAREHOLDER VALUE. I SAW A GUY DIE BECAUSE HIS INSURER TOOK 8 WEEKS TO APPROVE HIS ANTIBIOTIC. 8 WEEKS. WHILE HE WAS DYING. THEY’RE NOT SAVING MONEY-THEY’RE KILLING PEOPLE AND CALLING IT ‘EFFICIENCY’.

Wesley Phillips

December 15, 2025 at 04:46Look, I get the frustration-but let’s be real. The real villain isn’t step therapy. It’s the fact that drug companies charge $50,000 for a pill that costs $2 to make. Step therapy is just the symptom. Fix pricing, fix the system. Blaming insurers is like blaming the thermometer for the fever. The disease is the price tag.

Nancy Carlsen

December 15, 2025 at 08:26My cousin in Texas got her MS meds approved in 4 days because her doctor flagged it as urgent. But my cousin in Ohio waited 11 weeks. Same drug. Same diagnosis. Different state. That’s not healthcare-it’s a lottery. We need federal standards. No one should have to beg for the right to stay alive based on their zip code.

Ted Rosenwasser

December 16, 2025 at 19:41Let’s not romanticize generics. They’re not magic. I took a generic antidepressant and it turned me into a zombie. My psychiatrist had to write three letters, submit my bloodwork, and call the insurer personally. They finally approved the brand name after 6 weeks. I lost 18 pounds. I missed my sister’s wedding. The system doesn’t care about your life-it cares about your copay.

Ryan Sullivan

December 18, 2025 at 18:56Step therapy is a transparently predatory mechanism designed to exploit vulnerable populations under the guise of fiscal responsibility. The structural violence inflicted upon chronically ill patients through bureaucratic delay constitutes a form of institutionalized neglect. The moral bankruptcy of the American healthcare apparatus is on full display here.

Jane Quitain

December 19, 2025 at 04:43Just wanted to say I got my biologic approved after 3 months of fighting. I didn’t know you could call the insurer and ask for a case manager. That was the game-changer. My doc helped me fill out the forms and I kept copies of every email. Don’t give up. It’s a grind but you can win.