Lenalidomide Patent Expiry Timeline Calculator

Calculate Patent Expiry Timeline

Enter key patent expiration dates to see how patent stacking affects generic availability. The tool calculates when market exclusivity ends based on the patent landscape described in the article.

Patent Expiry Timeline

Based on your inputs, the patent landscape shows:

- First generic opportunity: 2025 (when compound patent expires)

- Full market exclusivity: Until 2035 (after all patents expire)

- Estimated generic launch: 2026-2028 (due to FDA approval process)

- Patent stacking effect: 10 years of extended exclusivity

This illustrates how patent stacking (as seen in the lenalidomide case) extends market exclusivity. In the actual case, Celgene extended exclusivity by 8 years beyond the original 20-year patent term through strategic patenting.

When a blockbuster cancer drug hits the market, the money behind it can spark fierce legal battles. The lenalidomide patent litigation refers to the series of lawsuits, patent challenges, and regulatory disputes surrounding the drug lenalidomide has become a textbook case for anyone watching pharma law.

Why lenalidomide matters

Lenalidomide, sold under the brand Revlimid, is an immunomodulatory agent originally tweaked from the notorious birth‑defect drug thalidomide. Lenalidomide is approved for treating multiple myeloma, mantle‑cell lymphoma, and certain anemias. Its ability to extend patient survival by months-and sometimes years-turned it into a $12 billion revenue stream for its owner, Celgene.

The patent road from discovery to market

Celgene (now part of Bristol‑Myers Squibb) secured its first U.S. patent in 2001, covering the active compound and a suite of formulation claims. Celgene is a biopharma company that pioneered lenalidomide’s clinical development filed the New Drug Application with the FDA the U.S. Food and Drug Administration, the agency that granted approval in 2005. Over the next decade, the company layered additional patents-covering dosing regimens, crystal forms, and manufacturing processes-creating a dense “patent thicket” that made it hard for competitors to design around.

Key challenges in the litigation landscape

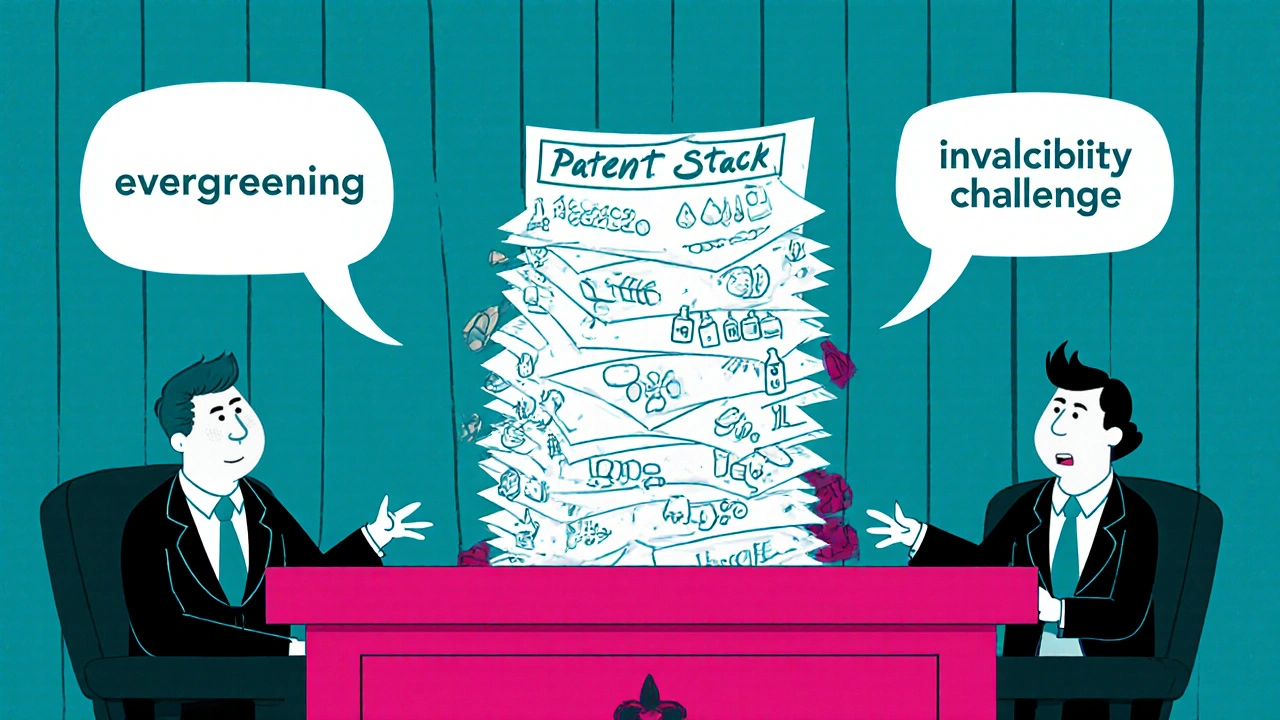

Three technical hurdles dominate the disputes:

- Patent stacking: Multiple overlapping claims let Celgene extend exclusivity well beyond the original 20‑year term.

- Evergreening: Minor tweaks, such as a new polymorph, are claimed as novel inventions, prompting challengers to argue they’re obvious.

- Invalidity attacks: Generic manufacturers submit prior‑art evidence showing the invention was known or obvious before the filing date.

Each move forces the challenger onto a costly legal runway, often stretching the case for years while patients wait for cheaper alternatives.

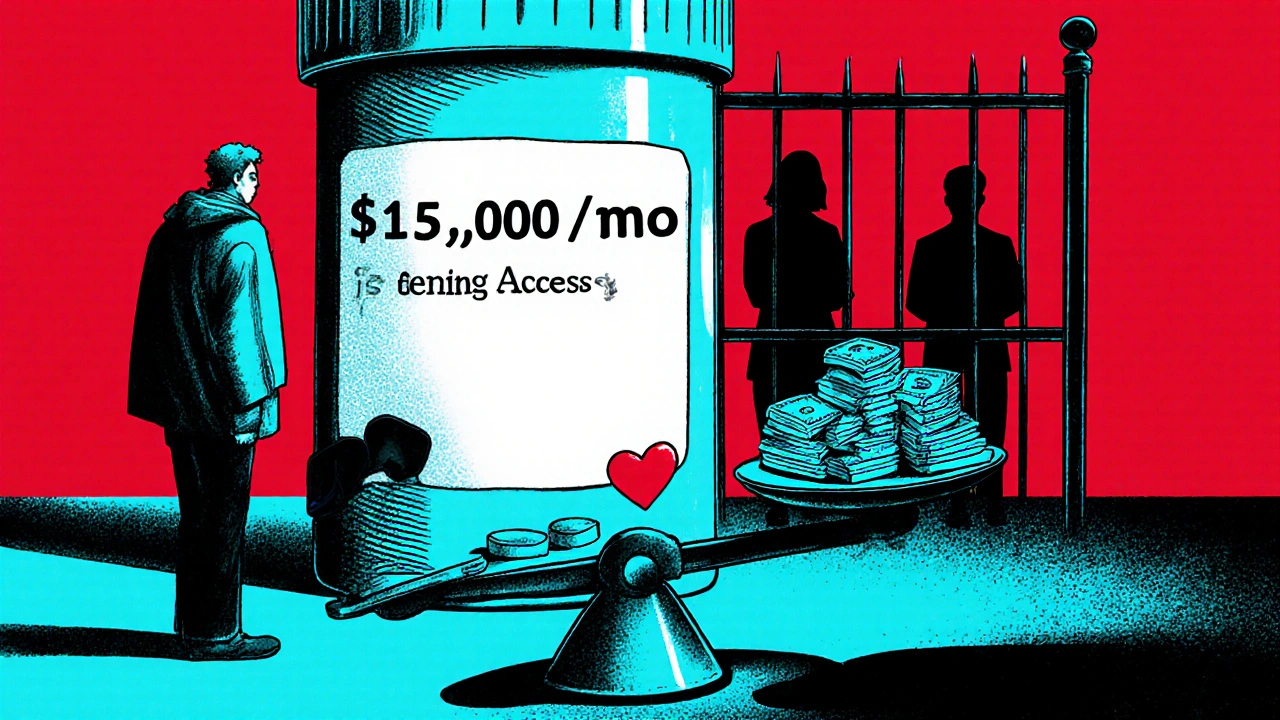

Controversial corners: pricing and access

Beyond the courtroom, the high price tag-often north of $15,000 per month in the United States-has sparked public outcry. Advocacy groups argue that aggressive patent enforcement inflates costs, limiting access for low‑income patients. Meanwhile, insurers negotiate rebates that are seldom disclosed, adding opacity to the pricing puzzle.

The ongoing lenalidomide patent litigation keeps the industry on edge.

Landmark court battles

Several high‑profile rulings have shaped the current landscape. The table below summarizes the most influential cases.

| Year | Parties | Outcome | Impact |

|---|---|---|---|

| 2012 | Celgene vs. Mylan | Court upheld formulation patents | Delayed generic entry by 5 years |

| 2016 | Celgene vs. Celltrion | Invalidated one method‑of‑use claim | Opened narrow pathway for biosimilar |

| 2020 | Celgene vs. Sandoz | Settlement; early launch of generic | Reduced price by ~30 % |

| 2023 | Celgene vs. European Patent Office | EP granted additional indication patent | Extended EU exclusivity to 2028 |

Notice how each decision rippled through both U.S. and European markets, reshaping launch timelines for generics and biosimilars.

Generic entry and biosimilar hurdles

Even after a patent expires, regulators may block a generic on “clinical relevance” grounds. The FDA’s generic drug is a version of a brand‑name medication that must demonstrate bioequivalence pathway requires extensive studies, especially for complex oncology agents.

In 2024, Mylan secured a tentative approval for a lenalidomide generic, but a subsequent “paragraph IV” certification challenged a lingering method‑of‑use patent, pushing the launch into 2026. Meanwhile, biosimilar developers in Europe argue that the drug’s small‑molecule nature should simplify the pathway, yet the European Patent Office’s 2023 decision added an indication patent that stalls biosimilar competition until 2028.

Global angles: Europe and beyond

The European Patent Office is the centralized body that grants patents across the EU member states has taken a more granular approach, granting separate patents for each therapeutic indication. This strategy, while legally sound, effectively creates multiple exclusivity windows across the continent.

Countries like Canada and Australia have their own patent statutes that mirror the U.S. approach, but local courts sometimes prioritize public health over strict patent rights, leading to earlier generic access in those markets.

Takeaways for industry and policymakers

- Patent strategies that rely heavily on stacking can draw regulatory scrutiny and public backlash.

- Transparent pricing and early‑access programs may mitigate the reputational damage of prolonged litigation.

- Policymakers should consider “patent term extensions” reforms that balance innovation incentives with patient affordability.

- Stakeholders must monitor both U.S. court rulings and European Patent Office decisions, as they often set precedent for global markets.

Quick checklist for anyone tracking the case

- Identify the core patents (compound, formulation, method‑of‑use) and their expiry dates.

- Watch for “Paragraph IV” certifications filed by generic firms.

- Track FDA and EMEA approval timelines for any new indications.

- Monitor settlement announcements-these often signal upcoming price drops.

- Review policy proposals on drug pricing and patent reform in major jurisdictions.

Final thoughts

Lenalidomide’s saga shows how a life‑saving drug can become a legal battleground. By understanding the patent stack, the key court rulings, and the broader policy debates, clinicians, investors, and patients can better navigate the uncertainty. Keep an eye on upcoming appellate decisions; they may finally tip the scales toward broader, more affordable access.

Frequently Asked Questions

What is lenalidomide used for?

Lenalidomide is an immunomodulatory drug approved for multiple myeloma, mantle‑cell lymphoma, and certain myelodysplastic syndromes. It helps stop cancer cells from growing and improves patients’ blood counts.

Why does lenalidomide remain expensive?

The high price is driven by a dense web of patents that extend market exclusivity, plus costly clinical development and manufacturing. Patent litigation delays cheaper generics, allowing the brand‑owner to keep prices high.

When will a generic version be available in the U.S.?

The most recent FDA tentative approval points to a launch in 2026, assuming no further successful patent challenges arise.

How do European patents affect US patients?

European decisions often influence global licensing agreements. If the European Patent Office grants an indication patent, the brand‑owner may negotiate worldwide exclusivity extensions, indirectly delaying US generic entry.

Can patients access lenalidomide through assistance programs?

Yes. The manufacturer and several nonprofit groups offer co‑pay assistance or free‑drug programs for eligible patients, though eligibility criteria can be strict.

Ericka Suarez

October 21, 2025 at 16:13Listen up, folks, this whole lenalidomide saga is a perfect illustration of how the American spirit gets trampled by overseas patent junkies. The drug may have been born out of a dark past, but today it's a shining example of US innovation that the world envies. Yet the patent thicket that Celgene built feels like a gilded cage designed to keep the cash flowing to foreign shareholders. They keep stacking patents like building blocks, each one extending their monopoly far beyond the original term. Evergreening? More like ever‑greasing the wheels of profit while patients suffer. The cost of Revlimid in the US is a slap in the face of anyone who believes in fair competition. It's not just about money; it's about national pride and protecting our own. When the European Patent Office throws another indication patent into the mix, it's another nail in the coffin of our healthcare system. And don't get me started on the price hikes that seem to be coordinated with political allies abroad. The whole thing reeks of a multinational conspiracism that puts profit over patients. We need to pull the plug on these abusive strategies before they bleed us dry. Think of the families who can't afford $15,000 a month – that's a crime worth fighting. The courts should be a battlefield for justice, not a playground for corporate lawyers. So I'm calling on regulators to smash these ever‑greening tricks, to be bold, to protect the American people. In the end, it's about keeping America strong, healthy, and free from pharma tyranny.

Jake Hayes

October 22, 2025 at 14:26Patents are precisely defined legal instruments; the stacking described is a textbook case of jurisdictional abuse. The court rulings have consistently upheld these claims, indicating a solid prior‑art basis.

parbat parbatzapada

October 23, 2025 at 15:26i think the whole thing is a massive cover up by big pharma, like they dont want anyone to see the truth behind the patents. the govt is in cahoots, i swear. they keep the drug locked up while we suffer.

Casey Cloud

October 24, 2025 at 08:06Lenalidomide's patent landscape is a classic case of strategic IP layering. Companies often file multiple claims covering formulation, dosage, and even crystal form. This creates a robust barrier for generic entrants. The FDA's paragraph IV certification adds another hurdle that can delay market entry for years.

Rachel Valderrama

October 24, 2025 at 21:59Wow, another $15K a month? Guess patients are just buying premium vibes now. 🙄

Dana Yonce

October 25, 2025 at 09:06Interesting! :)

Lolita Gaela

October 25, 2025 at 17:26The concept of “ever‑greening” leverages minor polymorphic variations to extend market exclusivity, a tactic well‑documented in pharmaco‑legal literature. By securing formulation patents, Celgene effectively creates a cascade of enforceable rights that delay generic competition. Moreover, the method‑of‑use claims, though arguably obvious, survive due to the deference afforded by the “obviousness” standard in the US Patent Court. This legal architecture underscores the importance of robust prior‑art databases for challengers. In practice, these strategies inflate the Net Present Value (NPV) of the drug portfolio significantly.

Ashok Kumar

October 25, 2025 at 22:59It's a shame that patients end up paying for the legal battles rather than the medication itself. The regulatory hurdles often feel like a maze designed to confuse. Finally, some clarity would be welcome.

Jasmina Redzepovic

October 26, 2025 at 04:56From a nationalistic standpoint, it's unacceptable that foreign patent extensions dictate American drug pricing. The layered patents represent a tactical manipulation of the USPTO system, essentially weaponizing IP to siphon wealth. While the biotech sector celebrates these wins, the broader public bears the burden. This is why policy reform must target the core of patent stacking. Only then can we reclaim control over essential medicines.

Esther Olabisi

October 26, 2025 at 09:06💡 Great breakdown! Still, the real victims are the patients 😅. Maybe a little less legal drama?

Ivan Laney

October 26, 2025 at 14:39Look, when you examine the chronology of the Celgene filings, you see a deliberate pattern: initial compound patent, followed swiftly by formulation claims, then crystal‑form patents, and finally method‑of‑use patents. Each of these is timed to expire just as the previous one is about to lapse, creating a seamless continuation of exclusivity. The legal doctrine of “patent thicket” is not a metaphor here; it's a concrete manifestation of strategic IP management. The impact on market dynamics is profound – generic manufacturers are forced to navigate a labyrinth of overlapping claims, often incurring prohibitive litigation costs. Moreover, the European extensions compound the issue, effectively globalizing the monopoly. This strategy, while legally permissible, raises ethical questions about the balance between rewarding innovation and ensuring public health. Regulators need to address these practices with clearer guidelines on patentability criteria. Otherwise, we risk institutionalizing a system that privileges profit over patients. In short, the lenalidomide case is a textbook example of how aggressive IP tactics can distort the pharmaceutical landscape.

Kimberly Lloyd

October 26, 2025 at 19:39In the grand tapestry of medicine, access to life‑saving drugs is a thread that binds us all. When patents become barriers rather than bridges, we must reflect on our collective responsibility. Hope lies in collaborative policy and compassionate innovation.

Sakib Shaikh

October 26, 2025 at 22:59Everyone loves to shout about “innovation,” but the reality is that many of these patents are just clever re‑packaging of known science. The method‑of‑use claim for Revlimid is a classic example – it’s basically a repurposing of a known mechanism. The courts keep bending the rules, letting companies claim novelty where there is none.

Devendra Tripathi

October 27, 2025 at 03:09For the love of controversy, I’d argue that breaking these patents would set a dangerous precedent for future drug development. The market would lose incentives, and we’d see stagnation. Let the legal games continue.

Vivian Annastasia

October 27, 2025 at 05:56Sure, let’s just ignore the patients while we argue about patents. 🙃