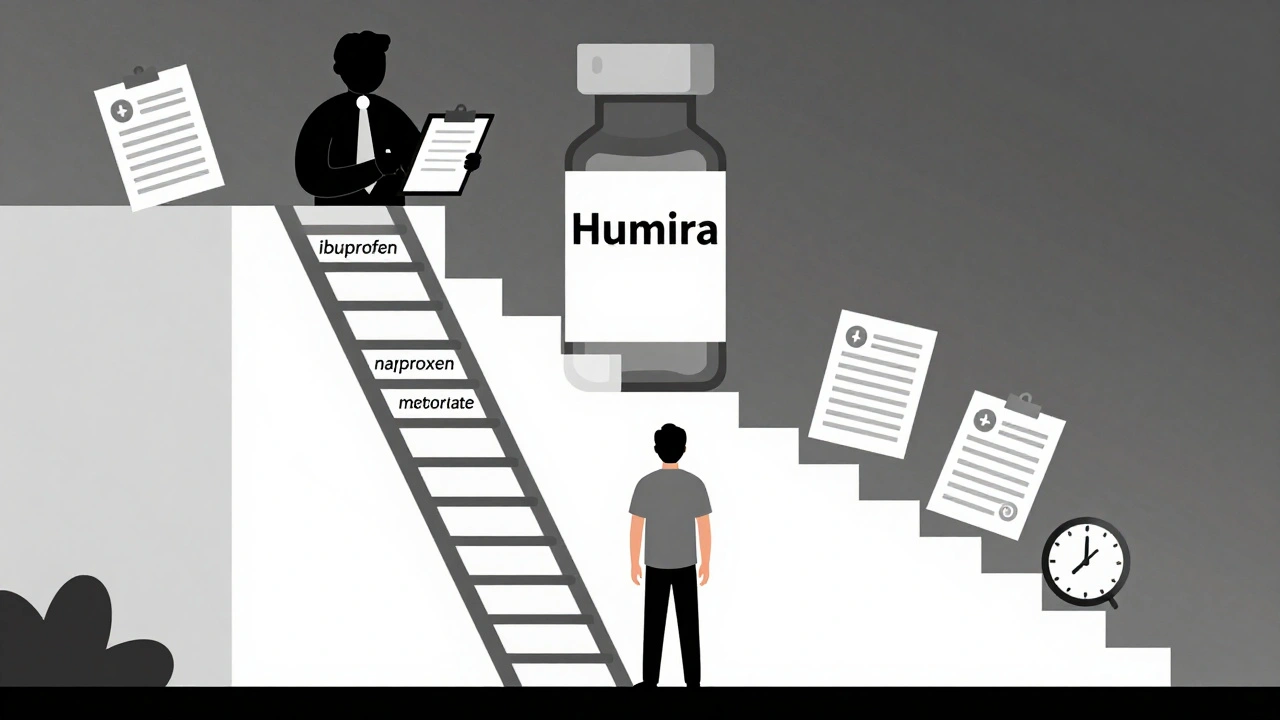

Step therapy forces patients to try cheaper generic drugs before insurers cover more expensive treatments. Learn how it works, when it fails, and what you can do to get exceptions quickly.

Insurance Formularies: How Pharmacies and Hospitals Decide Which Drugs Are Covered

When you walk into a pharmacy and your prescription isn’t covered, it’s not random—it’s because of an insurance formulary, a list of medications approved for coverage by a health plan or hospital system. Also known as a drug formulary, it’s the hidden rulebook that decides if you pay $5 or $500 for the same pill. This list isn’t made by your doctor or pharmacist. It’s built by pharmacy and therapeutics (P&T) committees—teams of doctors, pharmacists, and cost analysts—who weigh clinical data, price, and supply reliability every single day.

These committees don’t just pick the cheapest drug. They look at real-world outcomes: Does this generic actually work like the brand? Can we count on consistent supply? Are there hidden deals between manufacturers and insurers? For example, a hospital might choose one generic version of a blood pressure pill over another not because it’s better, but because the supplier offers volume discounts or rebates. That’s formulary economics, the financial logic behind drug selection in healthcare systems. And it’s why switching from one generic to another—even if they’re both FDA-approved—can sometimes cause problems for patients. Your insurance plan’s formulary also ties into pharmacy benefits, the structure that manages drug access, pricing, and coverage rules under health plans. These benefits shape everything from co-pays to prior authorizations, and they’re why some meds require paperwork before you get them.

What you’ll find in the posts below is a clear picture of how these systems actually work—not theory, but real cases. You’ll see how hospitals choose generics based on more than price, how FDA inspections ensure quality even in low-cost drugs, and why Australia’s public drug program cuts costs without sacrificing access. You’ll learn why biosimilars aren’t generics, how patient counseling catches errors before they happen, and how supply chain issues can suddenly make a life-saving drug unavailable. This isn’t about insurance jargon. It’s about what happens when money, regulation, and medicine collide—and how you can navigate it.