Most people assume the United States pays the most for everything medical - and they’re right about brand-name drugs. But when it comes to generic drug prices, the story flips. Americans often pay less for the same generic pills than people in Germany, France, or the UK. How is that possible? And why does it matter?

How the US Gets Cheaper Generics

In the US, 90% of all prescriptions filled are for generic drugs. That’s not because Americans are more frugal - it’s because the system pushes prices down hard. Generic manufacturers compete fiercely. With dozens of companies making the same drug - like lisinopril or metformin - they slash prices to win contracts from big pharmacy chains and Pharmacy Benefit Managers (PBMs). These PBMs don’t just buy drugs; they negotiate rebates, discounts, and volume deals that aren’t visible to the patient at the counter. The result? A month’s supply of generic lisinopril can cost $4 at Walmart or CVS. In Germany, the same pill might set you back €15. That’s not because German pharmacies are overcharging. It’s because their system doesn’t encourage the same kind of price war.Europe’s System Is Built to Protect Prices

European countries don’t have a free-for-all generic market. Most have centralized agencies that set drug prices. In France, the government decides what a drug should cost based on its perceived medical value. In the UK, NICE evaluates whether a drug is worth the price before the NHS will pay for it. Germany uses reference pricing - if a drug costs less in neighboring countries, Germany lowers its price to match. These systems are designed to keep overall spending low. But they also reduce competition. Fewer generic companies enter the market because profits are capped. With less competition, prices stay higher. Only 41% of prescriptions in Europe are for unbranded generics - far below the US rate. That means manufacturers don’t have to fight as hard to win sales.Why the US Pays More for Brand-Name Drugs

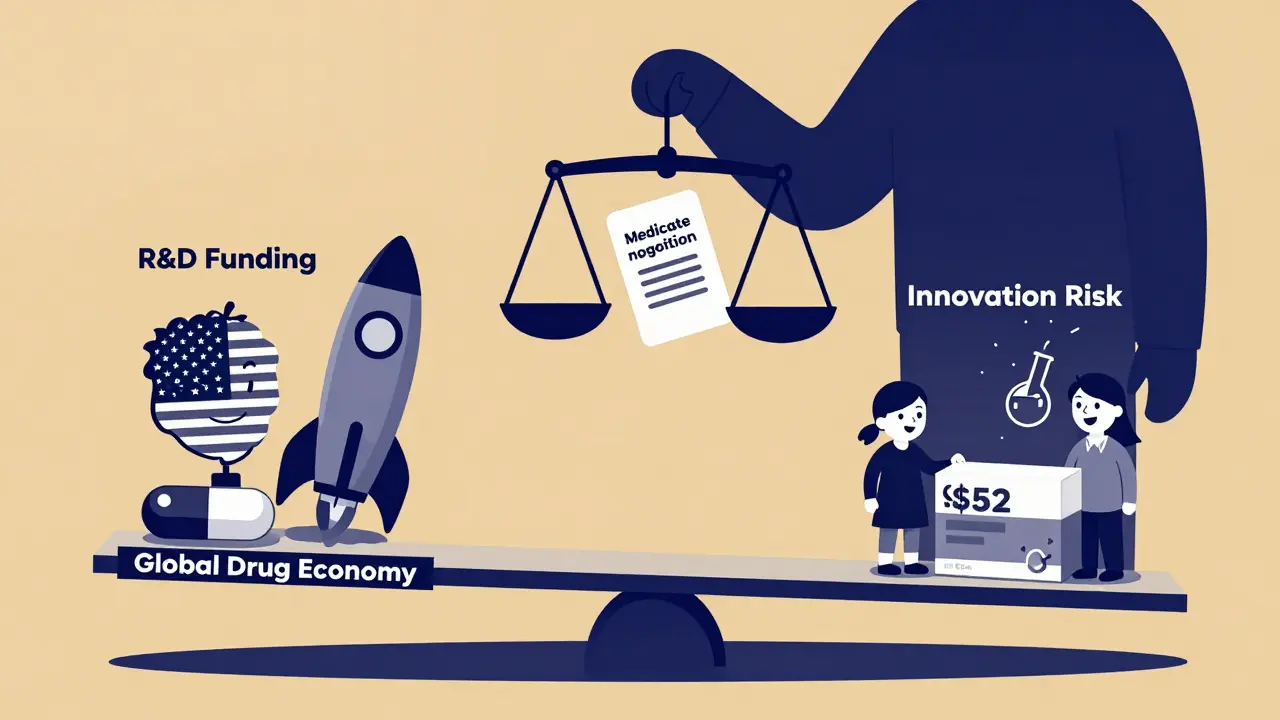

Here’s the twist: while Americans pay less for generics, they pay way more for brand-name drugs. A 2023 report from the US Department of Health and Human Services found that US prices for brand-name medications are more than three times higher than in other OECD countries. For example, Medicare negotiated a price of $204 for Jardiance, while the average price in 11 other countries was just $52. Why? Because the US system doesn’t negotiate prices the way Europe does. There’s no single entity telling drug companies, “This is what we’ll pay.” Instead, insurers, PBMs, and hospitals each negotiate separately. Drugmakers charge high list prices, then offer big rebates - sometimes 35-40% off - to get their drugs on insurance formularies. The patient never sees these discounts. They still pay the full list price unless their plan covers it. This is why the US is often called the world’s drug lab. The high prices for brand-name drugs fund most of the global research and development. About two-thirds of new drug innovation comes from companies based in the US, and they rely on American consumers to cover the cost of failure. A drug might cost $2 billion to develop and fail in 9 out of 10 trials. The profits from the one that works pay for all the others.

The Hidden Cost of Cheap Generics

There’s a downside to the US generic market’s intensity. When prices drop too low, companies stop making the drug. A pill that costs $0.05 per tablet might not even cover the cost of packaging and shipping. When that happens, manufacturers quit. Then, suddenly, there’s a shortage. Only one company is left making it - and they raise the price. This happened with doxycycline, a common antibiotic. In 2022, the price jumped from $0.10 to $1.50 per pill overnight because most manufacturers had left the market. The same thing occurred with injectable epinephrine and several chemotherapy generics. The system works well when there’s competition - but it breaks down when competition disappears.What Happens When Patients Travel

Americans who travel to Europe often get a shock at the pharmacy. One Reddit user wrote: “I paid €15 for a month’s supply of generic lisinopril in Germany that costs me $4 at Walmart.” That’s not a mistake. It’s the system working as designed. Conversely, Europeans visiting the US are stunned by brand-name prices. A 2024 survey by the European Patients’ Forum found that 78% of respondents thought US drug prices for patented medicines were “unjustifiably high.” They’re right - but they’re also benefiting from it. The high US prices for brand-name drugs help keep the global pipeline of new medicines flowing.

Edith Brederode

January 20, 2026 at 08:41OMG YES 😭 I paid $3.50 for my metformin at Walmart last week. My cousin in France just told me she pays €22 for the same thing. I feel bad for her but also kinda glad I live here? 🤷♀️

Arlene Mathison

January 21, 2026 at 17:56Let’s be real - the US system is a mess, but it works for generics. I’ve seen friends in Canada pay $80 for a 30-day supply of a generic blood pressure med. Here? I get it for a coupon at Target. The trade-off is brutal for new drugs, but if you’re on old meds? You’re winning. 🙌

Carolyn Rose Meszaros

January 22, 2026 at 14:01I work in a pharmacy and see this every day. People come in asking why their lisinopril is $4, and I tell them ‘competition, baby.’ Then they ask why their new diabetes drug is $1,200. I just shrug. The system’s weird, but it’s not broken - it’s just… different. 😅

Greg Robertson

January 23, 2026 at 06:05It’s funny how we don’t think about the global impact. We get cheap generics because we let manufacturers fight it out. Europe protects their prices, so fewer companies bother. But if the US starts capping brand prices too, those companies might just stop making generics here. Then we’ll all be stuck with $50 pills. 🤔

Nadia Watson

January 25, 2026 at 03:11It is important to recognize that the structural differences between healthcare systems reflect deeply rooted cultural values. In the United States, market-driven mechanisms are prioritized, whereas in many European nations, equity and universal access are central tenets. While the former yields lower generic prices, it also engenders systemic fragility, as evidenced by recurring drug shortages. The latter, though seemingly less efficient, sustains stability at the cost of innovation incentives. This is not a matter of superiority, but of prioritization.

Courtney Carra

January 26, 2026 at 15:38Think about it - we’re basically the drug world’s venture capitalist. We take the loss on 9 out of 10 drugs so the 1 that works can pay for everything. Europe gets the benefits without paying the price. It’s like you let your friend fund your startup, then you complain when they charge you for the product. We’re not the villains - we’re the ones holding the bag. 💭

thomas wall

January 27, 2026 at 15:32It is utterly disgraceful that the United States continues to exploit its position as the world’s pharmaceutical subsidy engine. While European nations enforce rational pricing to protect their citizens, American patients are forced to subsidize corporate greed under the guise of ‘innovation.’ This is not a market - it is a moral failure disguised as capitalism. Shame on you, America.

Paul Barnes

January 27, 2026 at 17:14Correction: the 2023 HHS report says brand-name prices are 3.1x higher, not ‘more than three times.’ Also, the Inflation Reduction Act only applies to 10 drugs, not ‘selected medications’ as a category. Details matter.

Manoj Kumar Billigunta

January 28, 2026 at 11:39My brother in India pays $0.50 for generic insulin. Americans pay $4? That’s luxury. We need to fix global access, not just compare US and Europe. Cheap drugs mean nothing if people in poor countries can’t get them at all.

Art Gar

January 28, 2026 at 14:47Of course the US pays less for generics - because the government doesn’t regulate them. That’s not a feature, it’s a bug. The moment the FDA or CMS steps in to ‘fix’ this, prices will go up. This system is a house of cards built on deregulation. And you call it ‘working’?

Crystal August

January 30, 2026 at 03:06So what? You think this is fair? People are dying because they can’t afford insulin while Walmart sells lisinopril for $4. This isn’t a ‘system’ - it’s a scam. The rich get drugs, the poor get shortages. And you’re just happy you got a discount? Pathetic.

Jacob Cathro

January 31, 2026 at 02:53PBMs are the real villains here. They’re middlemen who take 30% of your drug money and make it disappear. They negotiate ‘rebates’ that don’t help patients. That’s why your $4 pill costs the insurer $12. They’re not saving you money - they’re skimming it. And no one talks about it because they’re lobbyists with golden toilets.

clifford hoang

February 1, 2026 at 15:26They’re using cheap generics to fund the deep state’s pharmaceutical agenda. The FDA and Big Pharma are in cahoots - they let generics be cheap so you think the system works. But when you need a real drug? Boom. Price gouging. And the ‘innovation’ excuse? That’s just to keep you quiet. They’re controlling the entire supply chain. Watch the news - they’re already testing AI-driven drug pricing bots. This is a trap.

Andy Thompson

February 2, 2026 at 09:17USA F*** YEAH. We out here funding the world’s drugs while Europe sips wine and complains. If they want cheap meds, they can start paying for R&D. We’re not your drug vending machine. You want low prices? Build your own labs. We’re not your slaves.