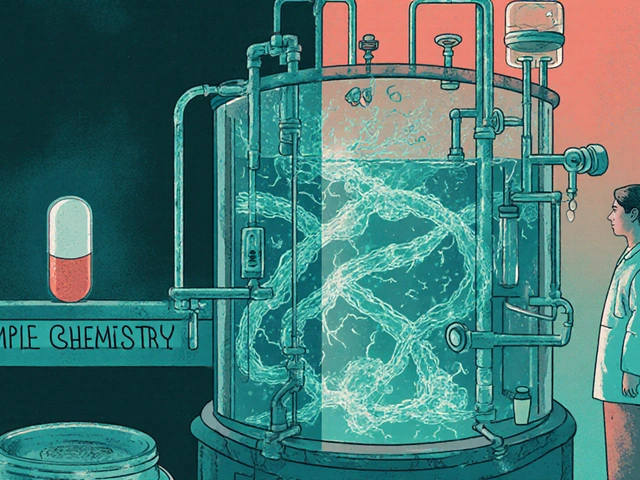

When you hear the word biosimilar, you might think it’s just another generic drug. But it’s not. Biosimilars are complex, living medicines-made from living cells-that copy highly advanced biologic drugs used to treat cancer, rheumatoid arthritis, diabetes, and more. These aren’t pills you can easily replicate. They’re intricate proteins, often requiring years of research and billions in investment to develop. And when they hit the market, they can slash prices by up to 30%. But here’s the twist: Europe has been using them for nearly two decades. The United States? It’s just catching up.

Europe Led the Way-And Built a System That Works

Europe didn’t just get lucky with biosimilars. It built the first real regulatory framework for them in 2006, when the European Medicines Agency (EMA) approved Omnitrope, the world’s first biosimilar. That wasn’t an accident. It was a strategy. The EMA created clear rules: you don’t need to repeat every single clinical trial from the original drug. Instead, you prove similarity through rigorous analytical testing, animal studies, and a few targeted human trials. That’s called the totality-of-evidence approach. It’s smart. It’s efficient. And it worked.

By 2024, Europe’s biosimilar market hit $13.16 billion in revenue. Germany, France, and the UK led the charge. Hospitals there started using tender systems-where they invite multiple suppliers to bid on contracts. Biosimilars, being cheaper, won. In some countries, oncology and rheumatology biosimilars now make up over 80% of the market for those drugs. Doctors trusted them. Patients trusted them. Payers pushed them. It became the norm.

Manufacturing also took root. Germany became a biosimilar powerhouse, home to major producers like Sandoz and Fresenius Kabi. These companies didn’t just sell-they built supply chains, trained staff, and created expertise that attracted global players. The system wasn’t perfect, but it was predictable. And predictability drove investment.

The US Started Late-And Got Stuck

The U.S. passed the Biologics Price Competition and Innovation Act (BPCIA) in 2009, six years after Europe. But approval? That didn’t come until 2015, when Zarxio, a biosimilar to filgrastim, finally cleared the FDA. Why the delay? Patent lawsuits. A confusing legal process called the “patent dance.” And fear.

Originator companies didn’t just sit back. They sued. They extended patents. They made deals with pharmacies to block biosimilars. By 2024, only about 12 biosimilars had launched in the U.S., compared to over 100 in Europe since 2006. Even when biosimilars were approved, many never reached patients because of legal barriers or payer resistance.

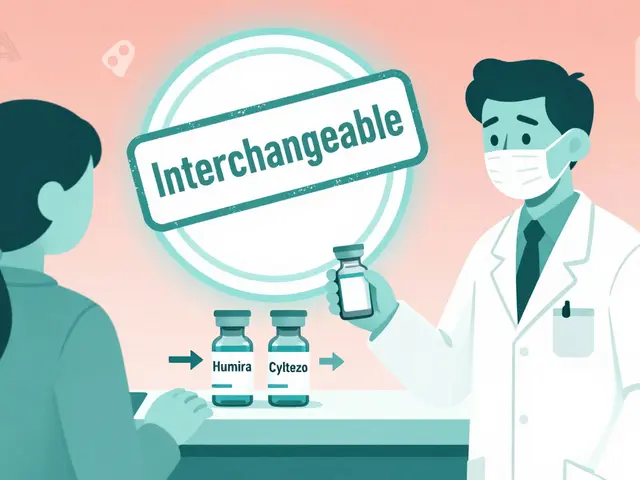

And then there was the interchangeability hurdle. To be called “interchangeable”-meaning a pharmacist could swap it for the brand drug without doctor approval-the FDA demanded extra clinical trials proving switching back and forth between the biosimilar and the original was safe. These “switching studies” added years and millions to development costs. Only a handful of U.S. biosimilars ever reached that status.

The result? A market that knew biosimilars could save billions-but couldn’t get out of its own way.

The Turning Point: June 2024

Everything changed in June 2024. The FDA proposed new rules: no more mandatory switching studies for interchangeable designation. That’s huge. It means companies can now get their biosimilars labeled as interchangeable with far less cost and delay. This wasn’t just a tweak-it was a pivot toward the European model.

Why now? Pressure. The Inflation Reduction Act of 2022 removed the Medicare Part D coverage gap, making biosimilars more financially attractive for seniors. Also, big biologics like Humira (adalimumab) started losing patents. Over 14 Humira biosimilars were approved by 2024. That’s a floodgate opening.

By 2024, the U.S. biosimilar market hit $10.9 billion. That’s still behind Europe-but the growth rate is faster. The U.S. market is projected to grow at 18.5% annually through 2033. Europe? Around 17.3%. The U.S. isn’t just catching up-it’s accelerating.

Market Differences: Who’s Buying What?

It’s not just about how many biosimilars exist. It’s about where they’re used.

In Europe, the biggest wins have been in autoimmune diseases: drugs for rheumatoid arthritis, Crohn’s disease, and psoriasis. Monoclonal antibodies like infliximab and adalimumab are the targets. Hospitals and governments pushed hard because these drugs cost tens of thousands per patient per year. Saving even 20% means millions back in the system.

The U.S. started differently. Early biosimilars were in supportive care-like filgrastim, which helps cancer patients recover white blood cells after chemo. Why? Simpler molecules. Lower risk. Easier to get approved. But now? The market is shifting. Biosimilars for diabetes (insulin), blood clot prevention, and even eye diseases are entering. The next wave? Oncology. Drugs like trastuzumab and rituximab are next in line for biosimilar competition.

And here’s the kicker: the U.S. has more high-revenue biologics coming off patent. IQVIA estimates $232 billion in sales will be up for grabs between 2025 and 2034. That’s more than Europe has. The U.S. isn’t just playing catch-up-it’s sitting on a goldmine.

Who’s Making Them?

Europe still leads in manufacturing. Sandoz (Novartis), Fresenius Kabi, and Biocon are major players. But the U.S. is catching up fast. Pfizer, Merck, and Samsung Bioepis now have strong U.S. footprints. And new entrants from India and China are setting up operations in the U.S. to serve this growing market.

What’s different? Europe’s companies built their businesses around biosimilars from the start. In the U.S., big pharma used to ignore them. Now? They’re investing billions. Why? Because the math works. A single biosimilar can capture 30-50% of the market within two years. That’s enough to offset lost revenue from the original drug.

What’s Next?

By 2027, North America could overtake Europe as the largest biosimilar market by revenue. Grand View Research forecasts North America will hit $17.2 billion by then. Europe will still be strong-but growth is slowing as markets mature.

Challenges remain. Manufacturing complex biosimilars is still hard. Regulatory requirements for next-generation biologics are getting tougher. And doctors? Many still don’t fully trust them. Patient education is lagging.

But the direction is clear. The U.S. is shedding its old barriers. Europe is refining its system. Both regions now agree on the science: if a biosimilar is approved, it’s safe and effective.

The real question isn’t whether biosimilars work. It’s whether healthcare systems will let them save money.

Why This Matters for Patients

Let’s say you have rheumatoid arthritis. Your doctor prescribes a biologic that costs $20,000 a year. Without a biosimilar, you’re stuck paying that-or going without.

With a biosimilar? Same results. Same safety. But now it’s $14,000. That’s $6,000 saved. For a family. For a hospital. For a state Medicaid program.

Biosimilars aren’t about cutting corners. They’re about making life-saving treatments affordable. Europe proved it’s possible. The U.S. is finally learning how to do it.

Prem Hungry

November 18, 2025 at 11:25man biosimilars are the real MVPs frfr 🙌 i work in a clinic in bangalore and we’ve been using them for years-same results, half the cost. why the u.s. took so long is beyond me. also, who’s paying for all those patent lawsuits? not the patients, that’s for sure.

Leslie Douglas-Churchwell

November 20, 2025 at 11:10Let’s be real-this isn’t about ‘affordability.’ It’s about Big Pharma’s controlled demolition of intellectual property under the guise of ‘patient access.’ 🤫 The FDA’s 2024 pivot? A backdoor to biologics commodification. And don’t get me started on the ‘interchangeability’ loophole-this is how you get pharmacists substituting life-saving drugs without a single physician signature. 🚨 #BioTrustCrisis #RegulatoryCapture

shubham seth

November 21, 2025 at 13:35Europe didn’t ‘get lucky’-they had the guts to tell Big Pharma to shove their patent extensions up their ass. Meanwhile, the U.S. spent 15 years playing legal whack-a-mole while patients bled cash. The ‘patent dance’? More like a corporate tango where only the lawyers win. And now? With Humira biosimilars flooding in, we’re looking at a $20B+ annual savings by 2027. Meanwhile, the FDA finally stopped being a handmaiden to pharma lobbyists. Took long enough. 🤷♂️

Kathryn Ware

November 22, 2025 at 17:40Just wanted to add a really important point-biosimilars aren’t just cheaper, they’re also more accessible in rural areas because the supply chains are simpler once you get past the regulatory hiccups. In places like rural Mississippi or Appalachia, where specialty pharmacies are scarce, having a biosimilar that can be stocked at a local pharmacy instead of requiring a specialty distributor is a game-changer. And the fact that insulin biosimilars are finally hitting the market? That’s literal life-saving equity. 💉❤️ I’ve seen patients choose between insulin and rent-this changes that. The U.S. is late, but the momentum now? It’s real.

Joseph Peel

November 22, 2025 at 19:24The regulatory divergence between the EMA and FDA is not a matter of efficiency versus bureaucracy-it is a reflection of fundamentally different philosophies of risk tolerance and market governance. Europe’s totality-of-evidence framework prioritizes scientific rigor without redundant clinical trials, whereas the U.S. historically privileged litigation-driven market entry over evidence-based adoption. The 2024 FDA rule change signals a paradigm shift toward harmonization, but the cultural resistance among prescribers remains a significant barrier to uptake. Systemic change requires not only regulatory reform but also physician education and patient trust-building.

Kelsey Robertson

November 24, 2025 at 13:44Wait-so we’re celebrating biosimilars… but ignoring that they’re still just knock-offs? 🤔 The ‘same safety’ claim is a myth-every protein folding variation, every glycosylation pattern, every excipient difference creates a unique biological signature. You can’t ‘prove similarity’-you can only prove ‘not obviously different.’ And now we’re letting pharmacists swap them like aspirin? What’s next? Generic brain surgery? 😏

Elia DOnald Maluleke

November 24, 2025 at 19:45In the grand theatre of global health, Europe played the role of the wise elder-patient, systematic, grounded in public good. The United States? The prodigal child, distracted by litigation, intoxicated by profit, until the bill came due. Now, with Humira’s patent walls crumbling, the empire has no choice but to kneel before the science. Yet even now, the fear of change lingers-in the doctor’s hesitation, in the payer’s caution, in the patient’s doubt. The biosimilar is not a threat. It is a mirror. And what it reflects is not failure-but the possibility of justice.

satya pradeep

November 25, 2025 at 19:41bro the real story is how indian pharma is quietly owning this. biocon, sun pharma-they’re not just making biosimilars, they’re building the entire supply chain from scratch. u.s. companies are scrambling to partner with them. europe’s got the volume, but india’s got the cost advantage + regulatory flexibility. also, why is no one talking about how the u.s. still has 10x more patent trolls than europe? it’s not a market failure-it’s a legal war.